As electricity markets become increasingly liberalized, the push for green, low-carbon transformation is reshaping global energy structures. Achieving carbon peaking and carbon neutrality targets makes energy the main battlefield—and electricity the primary force. In this context, renewable energy generation is undeniably critical, while energy storage stands at the very core.

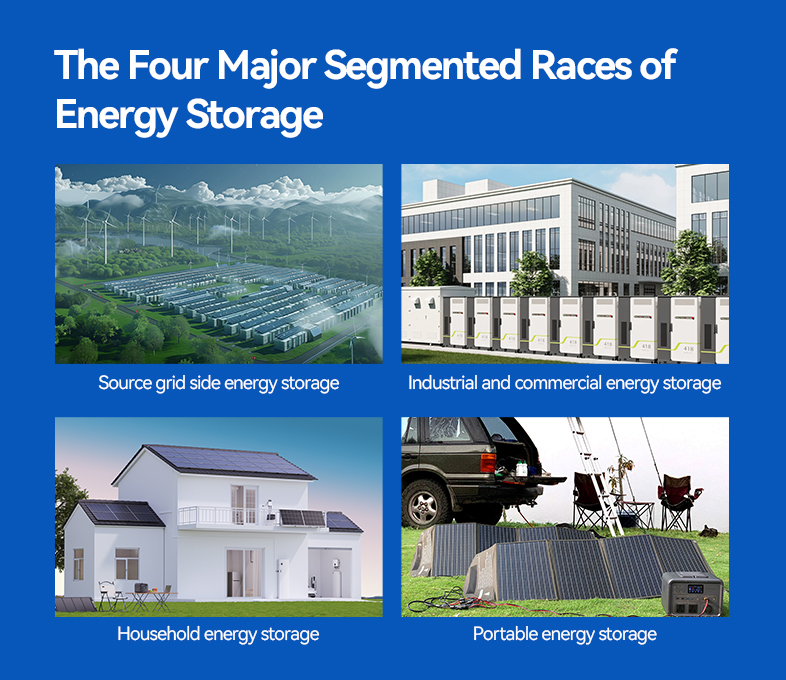

Energy storage products are now evolving into four distinct market segments, and this differentiation has already begun.

These differences will heavily impact how companies across the energy storage value chain position themselves, allocate resources, develop their products, and shape their growth strategies—making a segmented market analysis essential.

The Four Key Segments

-

Grid-side energy storage (Power Source & Grid)

-

Commercial & industrial (C&I) energy storage

-

Residential energy storage

-

Portable energy storage

Notably, the solar industry underwent a similar segmentation long ago—split into utility-scale PV (grid-side), C&I distributed PV, residential PV, and portable storage—each with its own market dynamics and investment logic.

Grid-side Energy Storage

Investors here are typically the existing power and grid enterprises, such as state grid companies (like SGCC’s Xinyuan focusing on pumped hydro) and large traditional power generators.

This segment is a highly buyer-driven market, where a small pool of investors holds significant bargaining power, constantly squeezing supplier margins.

From the downstream perspective, the only monetization pathway is selling ancillary services (like frequency regulation, reserves, and peak shaving) to provincial grid operators—essentially a single-buyer scenario.

What’s more, competition is fierce: flexible coal units, hydropower, gas turbines, and even large C&I storage systems or controllable loads (sometimes aggregated as virtual power plants) can all deliver similar services.

Commercial & Industrial (C&I) Energy Storage

Expected to become a 6 trillion RMB market, C&I energy storage sees multiple players—business owners, investors, integrators, EPC firms—collaborating under energy management contracts (EMC).

Its main business model:

-

Arbitrage on time-of-use (TOU) electricity price differences (charging at low prices, discharging at peaks), reducing energy bills.

-

Participating in virtual power plant (VPP) programs or demand response events.

As of June 2023, 19 regions in China already have peak-to-valley spreads over ¥0.7/kWh, making C&I storage increasingly economically attractive.

This segment also boasts the largest market capacity, far exceeding grid or generation-side, with established cooperative and operational frameworks. Well-run distributed storage plants can yield annual returns of 8% to 15%.

Energiespeicherung für Privathaushalte

Residential systems have become a crucial link in the energy storage value chain, and a golden track for future growth.

Typically combined with rooftop solar, these systems deliver clean, reliable power directly to households.

Global demand remains strong, with China’s Chemical & Physical Power Industry Association forecasting a 28% penetration rate by 2025. In Europe, it’s projected to soar from 18% in 2022 to 56% in 2025.

However, in China, the domestic residential market is somewhat constrained by grid companies’ commitment to ultra-reliable service, which reduces the economic incentive for homeowners to install storage. Moreover, the ROI on residential storage still remains relatively low.

Portable Energy Storage

Portable systems are compact power supplies with high energy density batteries that provide stable AC/DC output—ideal for outdoor adventures, emergency backups, and more.

Compared to small fuel generators, they’re safer, greener, quieter, easier to use, and offer a vastly improved user experience.

The wave of portable energy storage is already rising fast. With massive market potential and intense competition, which players will ultimately establish a solid foothold? We’ll have to wait and see. This market’s products and business models are still evolving.

In Summary: Each Segment Has Its Own Character

Differences in competitive forces, market maturity, policies, and customer needs mean energy storage products are splitting into four distinct markets: grid-side, C&I, residential, and portable. Each will differ in technologies, products, business, and operating models—with these differences becoming more pronounced the closer you get to the operations side.

The Future Lies in C&I Energy Storage — Building Core Competitiveness

In the march toward a market-driven storage sector, C&I energy storage is widely viewed as the true future direction—but the competition will be fierce.

Everyone’s getting involved: not just traditional power generators and grid operators, but also end users, distributed energy investors, ESCOs, VPP players, EV charging operators—and a growing list of cross-industry giants.

So how can a storage company secure success amid such intense competition?

RECREEN believes it boils down to four core competencies:

1. Technology Innovation & R&D Strength

Rapid advances in storage demand relentless innovation and R&D investment.

Continuous breakthroughs in reducing costs, improving efficiency, and optimizing performance are essential to maintain a technical edge. Storage tech is evolving at a blistering pace: new products are launching nonstop, lithium battery capacities and specs keep climbing, and thermal management has leaped from 1.0 to 3.0 in just a year. Without strong R&D, it’s hard to stay ahead.

2. Channel Development & Business Model Innovation

Channels are critical for downstream success. Mastering them will determine your market share.

Understanding local policies and customer needs through market research allows you to tailor optimal solutions for each C&I client.

Innovative models—like leasing, energy-as-a-service contracts, and more—are key to providing flexible options that meet diverse customer demands.

3. Capital & Partnerships

Storage is a capital-intensive industry. Growing the C&I market requires solid financing and strategic alliances.

Projects often need large investments, so tapping bank loans, venture capital, and forming partnerships with energy suppliers, industrial clients, and government bodies opens up more market opportunities and resources.

4. Project Design & Operational Expertise

In C&I storage, design and operations are vital to securing long-term returns.

You need skilled teams to craft optimal system designs that meet customer needs while ensuring safety and stability. Strong O&M capabilities—monitoring, maintenance, troubleshooting—are also essential for the long-term health of storage projects.